Innovative thinking on saving today…for tomorrow.

When it comes to retirement, the first question that usually pops up is, “How much should I save?”

Many financial advisors suggest a retirement savings equal to 70% of present income spread over a period of 20 years. Social security is included in that amount; however, social security benefits, that pay about 40% of workers’ salary, only gets us part of the way there.

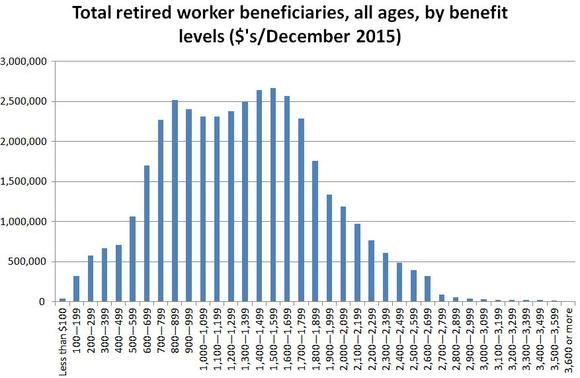

The monthly retirement benefit paid to retired workers varies widely, but most recipients will only receive between $700 and $1,800 per month in Social Security benefits. Such an amount may only be a fraction of what is needed to cover your monthly costs, and there’s no guarantee that it will be an option at all for future generations.

There are many different theories and formulas for calculating a desired retirement savings, but the generally accepted concept is that our retirement nest egg should include enough money to allow us to live in largely the same pre-retirement lifestyle from the moment of retirement to the end of our life.

So that answers the usual retirement question, but it’s also important that we ask how we should save for retirement. And that’s where innovation comes into play.

Employer-provided retirement plans are the easiest ways to save for retirement. Employers provide the plan options, employees set the savings amount, the money is automatically deposited into the retirement savings, and no one thinks about it until we get closer to retirement.

People who work for government entities and large corporations tend to have access to employer-facilitated retirement plans. Through these plans, employees are often provided an opportunity to allocate a certain amount of annual income (5% or more) that would be put into an investment fund and grow over time.

In many instances, employees can select the type of fund where their money goes. Think of the funds in terms of a scale that balances fund growth (profit) and risk (loss): conservative funds (that yield modest returns over time but also have little financial risk), aggressive funds (that return high profits, but can be subject to high losses. Risk here is greater.), and middle-of the road funds (that balance growth and loss somewhat better than conservative and aggressive funds).

But for a whole host of other workers like gig workers, seasonal workers, and contract workers – a whopping 57.3 percent of the private workforce—retirement savings is tricky. The people in this workforce never have access to convenient employer-sponsored retirement plans, so what are their options?

Two innovative plans have emerged as safe vehicles to help working Americans save for retirement.

The first comes from the Northwest, where the Oregon Legislature passed a measure to encouraging retirement savings for Oregon workers. The program established a state-administered retirement savings program and requires all employers who do not currently offer a qualified retirement plan, such as 401(k), 403(b), etc., to provide a vehicle for retirement savings via simple payroll deduction.

The plan is run by a professional, private-sector provider, and employees who do not wish to participate can simply opt-out. According to officials, “when fully launched, it is anticipated that the Plan may be made available to over one million Oregonians, which is over half the working population, and one quarter of all residents of the state”. These are impressive goals for a state of four million people.

Another retirement method was devised by Robert Merton and Arun S. Muralidhar at Mcube Investment Technologies. They have devised a low-cost, guaranteed retirement plan that is simple, affordable, and serves many functions. It’s got a cool name too.

They call it them SeLFIES – Standard of Living indexed, Forward-starting, Income-only Securities. Roughly, SeLFIES are a long-term bond that have a minimum payment of $5 which is paid for the typical life expectancy during retirement, e.g. 20 years.

Here’s an example for how the SeLFIES would work.

Savers start by determining how much money they will need each year of retirement. A 55-year-old today would by a 2027 bond, which would start paying coupons when she turns 65 in 2027, and keep paying for 20 years, through 2047. To guarantee $50,000 annually in retirement income, a worker would need to purchase 10,000 SeLFIES – i.e. $50,000 divided by $5 – over their working life. To have $100,000 annually in retirement income, workers would need to purchase 20,000 SeLFIES.

An added benefit is that the government is the issuer, which means that the cash flow generated from the SeLFIES purchase can be used to fund infrastructure.

So, two very different vehicles designed to ensure that working Americans can save for their own retirement, one with the added benefit of providing seed funding for shared infrastructure projects.

Either way, we encourage you to start saving now if you haven’t already. Retirement age creeps up on us all, so don’t wait, start saving today!

For more information:

https://www.ntia.doc.gov/legacy/opadhome/mtdpweb/sbfacts.htm

http://sbecouncil.org/about-us/facts-and-data/

https://www.plansponsor.com/selfies-can-improve-nations-retirement-security/?layout=print

12/08/2017: An invention aimed at revolutionizing retirement savings

http://www.marketplace.org/shows/marketplace-morning-report/12082017-us-edition